Unlocking Success: Your Guide to Stock and Options Trading Platforms

In the fast-paced world of financial markets, choosing the right trading platform can be the key to unlocking success in stock and options trading. With numerous platforms available, each offering a range of features and tools, finding the one that suits your needs is crucial for effective trading. This guide will explore what to look for in stock and option trading app, and how to make an informed choice to maximize your trading success.

Understanding Stock and Options Trading

Before diving into the selection of trading platforms, it’s essential to understand the fundamentals of stock and options trading.

Stock Trading

Stock trading involves buying and selling shares of individual companies through a stock exchange. Investors aim to profit from changes in the share price. This type of trading can be done on a short-term basis (day trading) or with a long-term perspective (buy and hold) with the help of a stock trading app.

Key Aspects of Stock Trading include:

- Market Orders: Buying or selling stocks at the best available price.

- Limit Orders: Setting a specific price at which to buy or sell stocks.

- Technical Analysis: Using charts and indicators to predict future stock price movements.

- Fundamental analysis: Assessing an organization’s performance and financial standing in order to make investment choices.

Options Trading

Options trading involves buying and selling options contracts that give traders the right, but not the obligation, to buy or sell an underlying asset at a specified price before a certain date. Options can be used for speculation and hedging.

Key Aspects of Options Trading include:

- Call Options: Contracts that give the holder the right to buy the underlying asset at a predetermined price.

- Put Options: Contracts that give the holder the right to sell the underlying asset at a predetermined price.

- Strike Price: The price at which an underlying asset can be purchased or sold is known as the strike price.

- Expiration Date: The date by which an option expires and loses all of its value is known as its expiration date.

Key Features to Look for in Trading Platforms

When selecting a trading platform for stock and options trading, consider the following features to ensure it meets your needs:

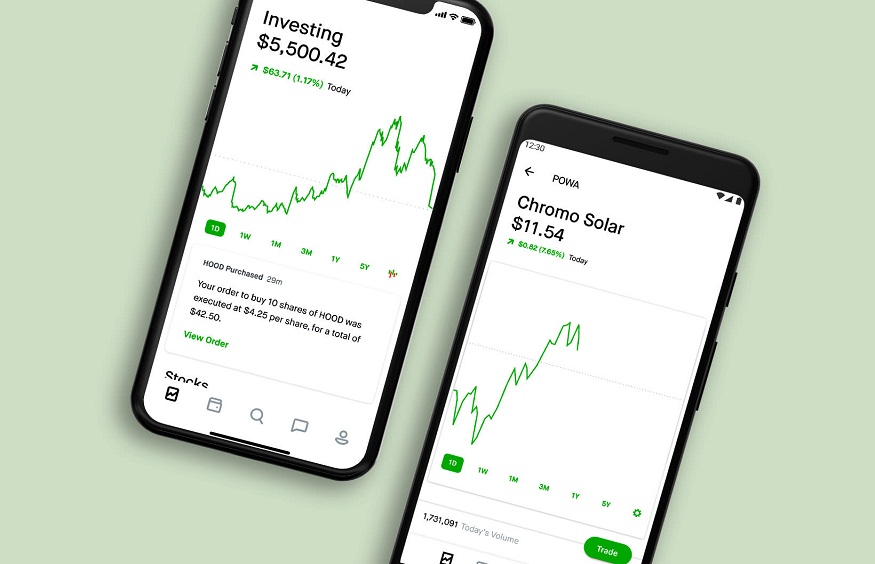

1. User-Friendly Interface

A platform with a user-friendly interface is essential, especially if you’re new to trading.

Look for platforms that offer intuitive navigation and clear, well-organized tools. You can explore how HDFC SKY, a stock trading app by HDFC Securities, can enhance your trading decisions.

An easy-to-use interface can make executing trades and accessing information quicker and more efficient, reducing the likelihood of errors.

2. Comprehensive Tools and Features

Effective trading requires a suite of tools and features, such as:

- Real-Time Data: Access to live market data and news updates is crucial for making informed decisions.

- Charting Tools: Advanced charting tools help analyze price movements and trends using various indicators and overlays.

- Technical and Fundamental Analysis: Features that support both types of analysis can enhance your trading strategy.

- Order Types: A range of order types (market, limit, stop-loss) allows for more precise trade execution.

3. Cost Structure

Understand the cost structure of the platform, including:

-

- Commission Fees: Fees charged per trade, which can vary between platforms.

- Spreads: The variation in an asset’s purchase and sale prices.

- Account Fees: Any monthly or annual fees associated with maintaining the account.

- Options Trading Fees: Specific fees related to options trading, such as per-contract fees.

4. Security and Reliability

Security is paramount in trading. Verify if the platform has strong security features, like:

- Encryption: Protects your personal and financial information.

- Two-factor authentication: Using two-factor authentication gives your account an additional degree of protection.

- Regulatory Compliance: Check if the platform is regulated by relevant financial authorities, which can provide an additional level of trust.

5. Customer Support

Reliable customer support can be a lifesaver if you encounter issues or need assistance. Look for platforms that offer:

- Multiple Contact Methods: Email, phone, and live chat support.

- 24/7 Availability: Access to support at any time, especially important for international trading.

6. Educational Resources

Platforms that provide educational resources can be beneficial, especially for beginners. Look for:

- Tutorials and Webinars: Videos and live sessions that cover trading basics and advanced strategies.

- Articles and Guides: Written content that explains trading concepts, tools, and market trends.

- Demo Accounts: Opportunities to practice trading with virtual money before committing real funds.

Conclusion

Unlocking success in stock and options trading begins with selecting the right platform that aligns with your trading goals and preferences. By focusing on key features such as ease of use, tools and features, cost structure, security, customer support, and educational resources, you can find a platform that enhances your trading expertise and aids in the accomplishment of your financial goals. Whether you are a seasoned trader or just starting, the right platform can make a significant difference in your trading success.