Current Ratio vs. Quick Ratio: What’s the Difference?

Have you heard of the Current Ratio and Quick Ratio? Both the financial ratios measure the short-term liquidity of a company. These are efficient tools for measuring the financial health of a particular business. Even though their functions look very similar, they differ in many aspects.

For example, the Quick Ratio is more conservative than the Current Ratio since it takes fewer things to calculate. The Quick ratio formula considers highly liquid assets only. We’ll discuss the details below.

So, let’s learn about these two crucial ratios displaying information about a business. And also find out the primary differences between the two. Which one is more suitable? Which is better to calculate the financial well-being of any business?

What is the Current Ratio?

Current Ratio calculates the potential of any business to pay off its short-term debts in one year. The Current Ratio considers the liquid assets like cash, inventory, accounts receivable, etc., along with the current liabilities, like accounts payable.

The calculation helps in understanding the solvency of a business. It is also known as the Working Capital Ratio.

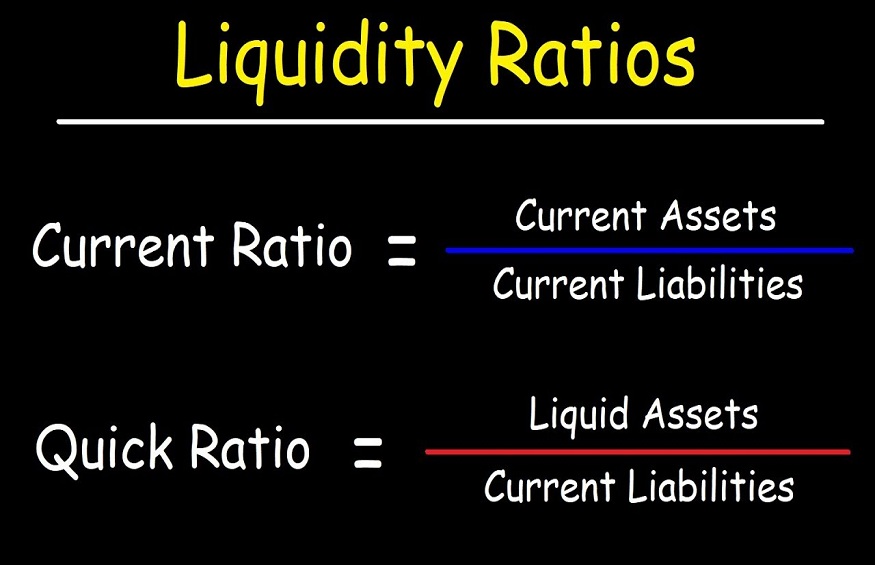

Current Ratio Formula

You can calculate the current ratio by using the below-mentioned formula:

Current Ratio = Current Assets / Current Liabilities

Usually, a current ratio of 2:1 is preferable and shows strong financial performance by any particular business.

You can also calculate this figure quickly by using the free calculator given below:

What is Quick Ratio?

The quick ratio also helps us to calculate the short-term financial obligation of any organization. It seems to be a handy tool for measuring the short-term debt-paying ability of any organization. It does so by considering the current assets and reducing the inventory. It is also called the Acid Test Ratio.

Quick Ratio Formula

You can calculate the quick ratio by using the below-mentioned formula:

Quick ratio = (Current Assets – Current Inventory) / Current Liabilities

Usually, a quick ratio between the ranges of 1:1 is preferable.

Current Ratio vs. Quick Ratio: What’s the difference?

As observed from the formulas, you calculate Quick Ratio by reducing the inventory from the current asset. This quick ratio tends to be more conservative.

On the other hand, a current ratio offers a picture of a business’s fiscal health, which is very convenient to use. Many potential investors analyze it to assess the financial health of a company.

Current Ratio vs. Quick Ratio: Which one is Better for a Business?

A low current ratio indicates that an organization may not meet its financial obligations very soon. Even though things look not good, but it is not uncommon for the startups as at the initial state, as they wish to accumulate debts.

If the current ratio is too high, it may indicate the business holds a large amount of cash and not investing it into the business. The current ratio measures the liquidity and provides the idea about the efficiency of any business’s operating cycle to the investors and financial analysts.

Investors analyze the current ratio and get an idea like if any business can generate constant revenue. If it does, then investors can also collect their accounts receivables promptly. This fact adds to the significance of ratios for potential investors. You can judge a lot about the finances of an organization.

A quick ratio is equally important as a current ratio. The difference being that inventory is excluded from short-term assets.

The reason, any particular business may not convert their inventory into cash quickly. And this may not be sufficient for conducting financial analysis for any potential investors.

However, Quick Ratio sometimes does not give the investors a complete view. For instance, a business may have a substantial amount in account receivables leading to a low quick ratio. Still, the fiscal health of your business could be strong enough.